How to Manage Remote Employees with TaxDome: A Complete Guide for Smarter Workflow and ?? Integration

Introduction: Why Managing Remote Employees Requires Smart Tools

In a world where remote work is no longer the exception but the norm, businesses and accounting firms are constantly seeking efficient tools to manage workflows, communication, and accountability across dispersed teams. Among the digital solutions gaining traction is TaxDome, an all-in-one practice management platform tailored for tax and accounting professionals. When paired with the growing demand for integrating AI features or ambiguous functionalities symbolized by “??” — perhaps chatbots, task managers, or other enhancements — the question becomes not just how, but how effectively you can manage your remote workforce.

This comprehensive article explores how to manage remote employees with TaxDome, ??, detailing strategic features, use cases, and workflows that support efficient remote team management.

Understanding the Core of TaxDome for Remote Team Management

TaxDome is more than a client portal. It combines CRM, project management, communication tools, and document handling into one secure platform. To manage remote employees, it’s essential to leverage all these components in a unified way.

Key core capabilities include:

- Secure document storage and sharing

- Automated workflows and task assignments

- Internal chats and communications

- Role-based permissions

- Time tracking and billing

Understanding these features provides the foundation for effectively managing remote employees with TaxDome, ??.

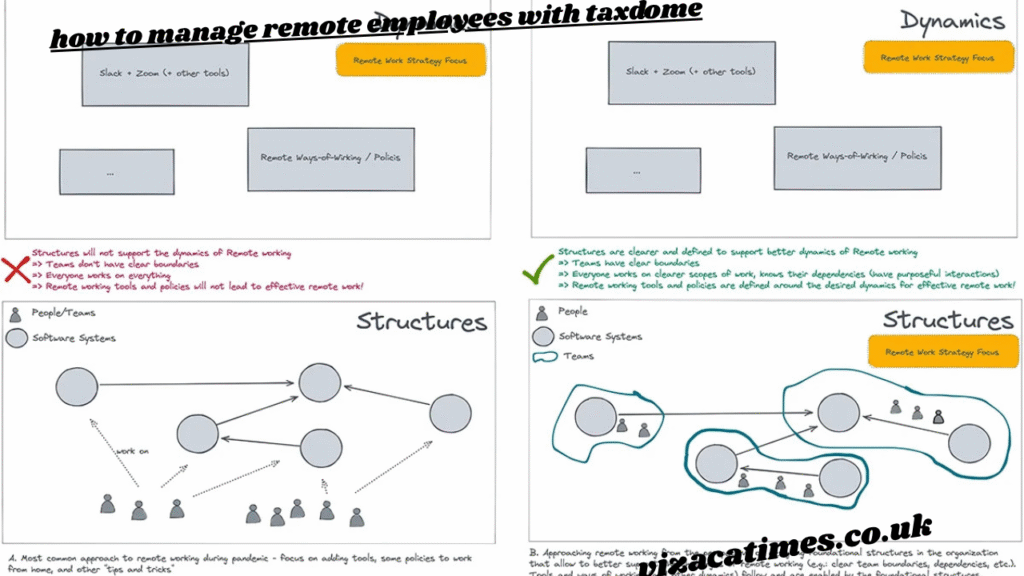

Setting Up an Efficient Remote Team Structure in TaxDome

Before remote work can flourish, team structures must be clearly defined. Here’s how to use TaxDome for building that solid foundation:

1. Define User Roles and Access Levels:

Assign role-based permissions to each remote employee. For instance, a senior accountant can access full client details, while a junior staff member may have access only to assigned tasks or folders.

2. Onboard Employees with Templates:

Create standardized onboarding workflows. Use automation to send documents, request digital signatures, and assign tutorials. This reduces manual intervention and ensures a consistent experience for every new remote employee.

3. Create Team Pipelines:

TaxDome’s pipelines help visualize and manage work at every stage. Design separate pipelines for client intake, document collection, review, and filing. Assign stages to specific remote workers for easy tracking.

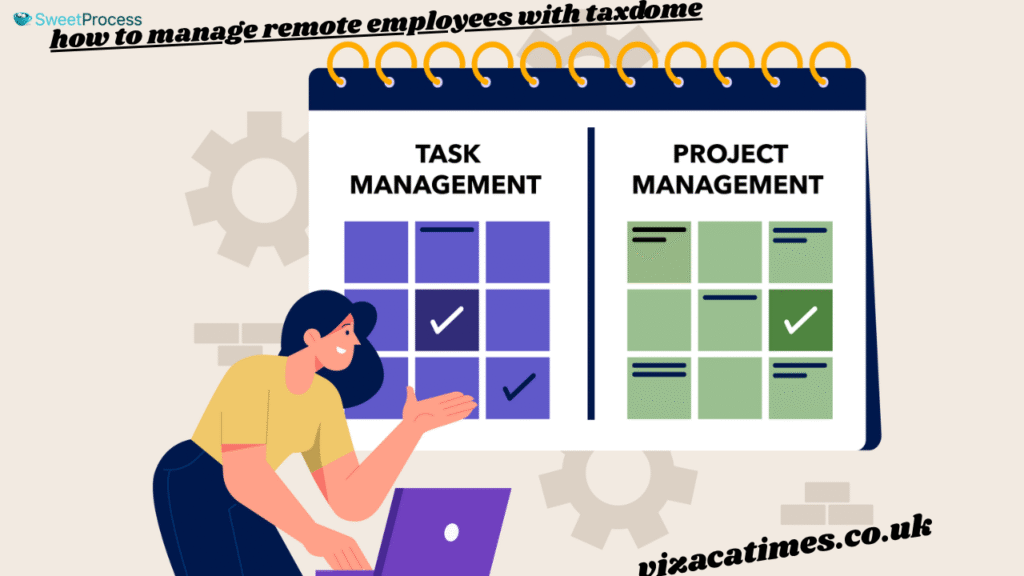

Task Management and Assignment: The Remote Backbone

Tasks are the cornerstone of remote productivity. Here’s how to manage them using TaxDome, ?? systems:

1. Use Automations to Trigger Tasks:

When a client uploads a document, automatically assign a review task to the appropriate team member. Automation rules can be configured based on client tags, services, or form completions.

2. Task Templates Save Time:

Avoid reinventing the wheel. Create task templates for common processes like tax returns, bookkeeping, or payroll reviews. Assign deadlines, tags, and default assignees.

3. Manage Workloads with To-Do Lists and Boards:

Team members can view their task lists, sort by deadline or priority, and see their responsibilities across projects using boards. Managers can reassign or prioritize tasks in real-time.

Streamlined Communication Across Time Zones

Effective communication is essential when teams are distributed across cities or continents. Here’s how TaxDome supports real-time and asynchronous communication:

1. Use Internal Chats within Client Accounts:

Instead of endless email threads, team members can discuss client work inside the secure portal. These messages stay connected to the client profile for future reference.

2. Use Notes for Updates and Handoffs:

Sticky notes and task notes are useful for tagging colleagues, leaving instructions, or documenting decisions. This ensures continuity even if employees work on rotating shifts.

3. Use Prebuilt Email Templates and Bulk Messaging:

TaxDome enables managers to send standardized emails to clients and CC remote staff for updates. This keeps everyone in the loop, whether they’re in the office or remote.

Secure Document Sharing and Collaboration

Security is non-negotiable in accounting and tax firms. Managing remote employees also means maintaining compliance and ensuring that files are handled with care:

1. Secure File Access:

TaxDome’s permission settings ensure that employees only access what they need. Audit trails track every document opened, downloaded, or modified.

2. Collaborative Editing and Document Versioning:

Team members can upload different versions of files and leave internal comments. This makes collaborative work — like reconciling statements or reviewing tax drafts — efficient and traceable.

3. E-Signature Integration:

Remote employees don’t need to rely on separate e-sign tools. TaxDome’s built-in e-signature allows remote teams to get client approvals swiftly and securely.

Time Tracking and Performance Monitoring

Remote team oversight doesn’t need to feel like micromanagement. TaxDome enables performance tracking that’s transparent and fair.

1. Use Time Tracking for Billing and Payroll:

Remote employees can log hours spent on client tasks. This helps managers understand workload distribution and justifies billing to clients.

2. Generate Reports to Track Output:

Managers can run reports on completed tasks, pending work, turnaround times, and overdue assignments. This makes team evaluation data-driven.

3. Monitor Login Activity and System Usage:

For added accountability, TaxDome provides audit logs showing when users log in, access documents, and complete actions.

Training and Development via Knowledge Integration (??)

The mysterious “??” aspect in how to manage remote employees with TaxDome, ?? can be interpreted as integrating intelligent tools like knowledge bases, bots, or even AI support to train and guide remote teams.

1. Embed Internal Knowledge Libraries:

Use the platform’s secure storage to house SOPs (Standard Operating Procedures), video tutorials, and reference materials. These are vital for onboarding or upskilling remote staff.

2. Smart Bots or Task Reminders:

Custom automation can serve as virtual assistants. They remind employees of upcoming tasks, incomplete forms, or missing documents — functioning like mini-AI helpers.

3. Link Learning Paths with Tasks:

Assign educational materials within a task’s description. Example: Attach a PDF guide to a new tax form procedure so employees learn as they do.

Maintaining Team Culture and Accountability

Remote doesn’t mean disconnected. Keeping your team aligned, supported, and engaged is part of effective remote employee management.

1. Weekly Check-ins and Status Updates:

Use TaxDome’s task commenting and chat features to schedule brief check-ins. Employees can update on their progress asynchronously.

2. Celebrate Milestones Digitally:

Create internal tasks for birthdays, promotions, or “job well done” shoutouts. Use team pipelines not just for work — but for team morale too.

3. Encourage Feedback Loops:

Have employees leave comments on workflows, process hiccups, or client communications. Use this feedback to iterate and improve systems.

Scaling and Futureproofing Your Remote Team

Once the basics are running smoothly, scaling remote operations with TaxDome becomes a matter of duplicating successful systems.

1. Clone Pipelines for New Services or Teams:

Got a new department? Use existing templates, workflows, and automations to scale quickly.

2. Audit Your Systems Regularly:

Every few months, review task flows, permissions, and usage patterns. Update templates and eliminate bottlenecks.

3. Explore Integration Options (??):

TaxDome may not currently integrate advanced AI or third-party tools natively, but firms can supplement it with external dashboards, scheduling software, or bots for holistic team management.

Final Thoughts

Managing remote employees may seem complex, but with the right platform, it becomes a streamlined, scalable, and secure process. How to manage remote employees with TaxDome, ?? is more than just a question — it’s a pathway toward smarter operations, empowered staff, and efficient client service. By utilizing TaxDome’s robust features and interpreting “??” as your team’s unique needs — be it AI, automation, or smart training — you can build a modern, future-ready remote workforce.

Also Read : India Equity Partners, ?? – A Deep Dive into Its Operations, Legacy, and Strategic Importance