India Equity Partners, ?? – A Deep Dive into Its Operations, Legacy, and Strategic Importance

Introduction to India Equity Partners, ??

India Equity Partners, ?? is a name that has become synonymous with private equity investments in emerging markets, especially India. As an investment firm, it has played a transformative role in various sectors including healthcare, retail, logistics, and education. Known for its strong investment strategy and a keen eye for long-term value creation, India Equity Partners, ?? has influenced how private equity firms operate in one of the world’s fastest-growing economies.

But what exactly is India Equity Partners, ??, and why has it drawn attention from analysts, business strategists, and entrepreneurs alike? This article explores its origins, its core sectors, its portfolio highlights, and its role in reshaping Indian businesses.

The Foundation and Vision Behind India Equity Partners, ??

India Equity Partners, ?? was founded with a clear mission: to identify high-growth potential companies in India and provide the capital and strategic direction necessary for scaling. With the economic reforms in India from the 1990s onward, the market became ripe for private equity investments. India Equity Partners, ?? positioned itself at the intersection of capital and opportunity.

The firm was designed not only to provide funds but also to offer operational guidance. Its model emphasizes active engagement with portfolio companies, creating value beyond financial injection. The firm has focused heavily on mid-market investments—companies that are often family-run or transitioning from entrepreneurial to corporate structures.

Core Investment Philosophy of India Equity Partners, ??

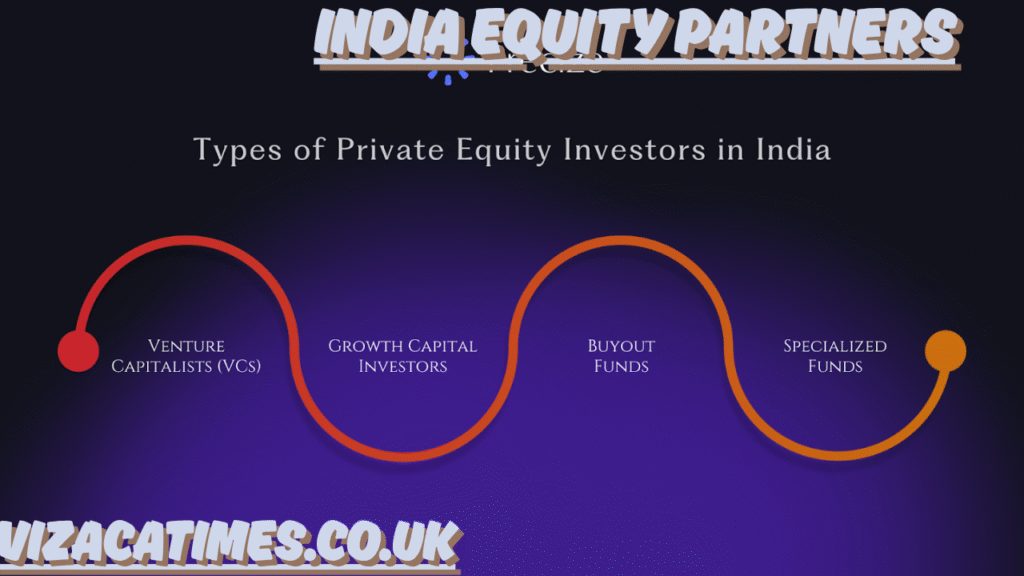

India Equity Partners, ?? has always followed a disciplined investment approach, driven by three major pillars:

- Sector Focus: The firm strategically targets high-growth sectors such as healthcare, education, retail, logistics, and consumer services. These sectors have historically seen robust demand in India due to demographic shifts, urbanization, and an expanding middle class.

- Operational Improvement: Unlike passive investors, India Equity Partners, ?? emphasizes hands-on management. It supports its portfolio companies through operational restructuring, leadership development, and better governance practices.

- Long-Term Growth Orientation: While some private equity firms focus on quick turnarounds, India Equity Partners, ?? is known for its long-term horizon. The aim is to nurture companies to become industry leaders before exiting through IPOs or strategic sales.

Sectors Targeted by India Equity Partners, ??

Understanding the sectors where India Equity Partners, ?? operates is crucial to grasping its strategic influence:

Healthcare

India’s rapidly evolving healthcare sector has presented both challenges and opportunities. India Equity Partners, ?? has made several investments in hospital chains, diagnostic companies, and healthcare services platforms, ensuring access to quality care while enabling scalable growth.

Education

As India modernizes, the demand for quality education across urban and rural regions has soared. India Equity Partners, ?? has invested in schools, ed-tech companies, and vocational training enterprises, driving improved infrastructure and digital learning methods.

Retail and Consumer Goods

India’s retail sector is undergoing a digital transformation. By investing in retail chains and e-commerce-related businesses, India Equity Partners, ?? has backed ventures that cater to the new-age consumer, including lifestyle products and FMCG.

Logistics and Infrastructure

Efficient logistics are critical for India’s economic expansion. India Equity Partners, ?? has taken stakes in warehousing, transportation, and logistics tech companies that serve growing industrial and e-commerce needs.

Key Portfolio Companies Backed by India Equity Partners, ??

Over the years, India Equity Partners, ?? has built a strong portfolio of companies that have grown to become leaders in their respective sectors. While the names vary over time due to acquisitions, mergers, and exits, a few notable examples include:

- Healthspring: A primary healthcare provider network that received funding and strategic support to expand across multiple Indian cities.

- IL&FS Education: With a focus on digital content and education solutions, this company benefited from the firm’s strategic push toward modernizing education.

- Ocean Sparkle: One of India’s leading marine services companies, backed by India Equity Partners, ?? for operational scaling and infrastructure investment.

India Equity Partners, ?? and Its Role in the Indian PE Landscape

India Equity Partners, ?? is not just another PE firm—it is a catalyst for structural transformation in the companies it invests in. By focusing on scalable businesses and instituting strong governance models, the firm has helped many companies professionalize and prepare for future expansions or IPOs.

Its hands-on approach makes it particularly attractive to founders who are looking for more than just financial capital. This strategy is a differentiator in a crowded investment market and is key to the firm’s long-term success.

Impact on India’s Business Ecosystem

India Equity Partners, ?? has contributed significantly to India’s startup and business ecosystem by:

- Providing critical growth capital to mid-sized enterprises.

- Introducing global best practices in corporate governance.

- Helping transition traditional businesses to tech-enabled models.

- Boosting employment and training through investments in education and healthcare.

The ripple effect of these investments is felt in improved service quality, better infrastructure, and increased competitiveness in the sectors it touches.

Challenges Faced by India Equity Partners, ??

No investment journey is without its hurdles. India Equity Partners, ?? has faced its share of challenges including:

- Regulatory uncertainties in sectors like education and healthcare.

- Delays in policy implementation affecting infrastructure investments.

- Market volatility that influences valuation and exit timing.

Despite these issues, the firm has managed to sustain its relevance through adaptive strategies, local expertise, and risk mitigation frameworks.

What Sets India Equity Partners, ?? Apart?

Several features distinguish India Equity Partners, ?? from other investment firms operating in India:

- Local Expertise + Global Insights: The firm combines Indian market understanding with global investment methodologies.

- Scalability Focus: It targets businesses with proven models and unmet demand, ensuring room for growth.

- Management Involvement: Deep engagement with the leadership of portfolio companies results in real-time problem-solving and quick pivots when necessary.

The Future of India Equity Partners, ??

As India marches ahead toward becoming a $5 trillion economy, private equity is set to play a larger role than ever before. India Equity Partners, ?? is well-positioned to benefit from this trajectory, especially with sectors like health tech, green logistics, and sustainable retail gaining momentum.

Looking ahead, the firm is expected to expand its presence across Tier-2 and Tier-3 cities, exploring untapped opportunities while maintaining its emphasis on governance and value creation.

FAQs About India Equity Partners, ??

Q: What does India Equity Partners, ?? invest in?

A: It focuses on healthcare, education, retail, logistics, and other high-growth sectors.

Q: Is India Equity Partners, ?? a global firm?

A: While it primarily invests in India, its investment approach is global in strategy, often aligned with international standards.

Q: How does India Equity Partners, ?? add value to companies?

A: By providing capital, operational guidance, strategic support, and improving governance.

Q: Who are the typical clients or partners of India Equity Partners, ??

A: Mid-sized enterprises, family-owned businesses, and high-potential startups looking to scale.

Q: What is the exit strategy for India Equity Partners, ??

A: It includes IPOs, strategic sales, and secondary buyouts, depending on market conditions and the maturity of the portfolio company.

Conclusion: India Equity Partners, ?? as a Force for Growth

India Equity Partners, ?? has carved out a critical role in the Indian private equity landscape. By investing in scalable businesses, providing strategic value, and maintaining a long-term outlook, it has contributed to the evolution of several Indian enterprises.

Also read : WRE Inc: A Closer Look at the Company and Its Role in Industry